Demerger and Refinancing update

TalkTalk Group today provides an update on the previously announced demerger process and refinancing plans.

Demerger process

Significant progress has been made since H124 update (27/11/23) towards the separation of our network wholesale platform business (“PlatformX Communications” or “PXC”) and our residential broadband customer business (“TalkTalk Consumer”), which will continue to trade under the TalkTalk brand.

- The two businesses will trade independently from 1 March, with a long-term exclusive wholesale agreement in place by which TalkTalk Consumer will benefit from access to the PXC network.

- PXC, led by CEO Tom O’Hagan, is the UK’s fastest growing independent scale provider of B2B connectivity and ICT services to the UK wholesale market, backed by a state-of-the-art platform which seamlessly consolidates products and capabilities.

- TalkTalk Consumer, led by CEO Adam Dunlop, is home to 2.4 million residential broadband customers and the only scale value player in the residential broadband market.

- The existing TalkTalk Holdings board will remain in place until the refinancing is complete. Sir Charles Dunstone will continue as Chair and Dame Tristia Harrison as CEO until that time.

- The Group is well advanced in defining and delivering material cost benefits associated with the separation.

Update on refinancing plan

Good progress has also been made on plans to refinance the Group’s RCF facilities and senior secured notes with maturities in November 2024 and February 2025 respectively.

- The Group has entered into an exclusivity agreement with a global financial institution to progress its offer of a significant investment of new equity into PXC.

- The PXC equity investment offer is subject to confirmatory due diligence, internal and regulatory approvals, finalising the terms of the PXC debt financing and the finalisation and execution of definitive transaction agreements.

- It is made on the basis that the TalkTalk Consumer business would be separated out of the existing group structure on completion.

- We are working in partnership with the same financial institution to raise new debt facilities on PXC from third party lenders.

- A debt raise process on the TalkTalk Consumer business is also ongoing.

- It is intended that the total proceeds from the equity investment and third-party debt facilities will be sufficient to refinance the Group’s existing debt facilities in full.

- Whilst well progressed, there can be no certainty that the PXC equity investment offer and associated debt raises will successfully complete or if they do on what terms.

- In parallel with progressing these plans for raising new capital to refinance existing debt facilities, the Group will also be engaging with key stakeholders among its existing lenders and noteholders on alternative or complementary proposals, which may include proposals to extend the maturities of the existing debt facilities.

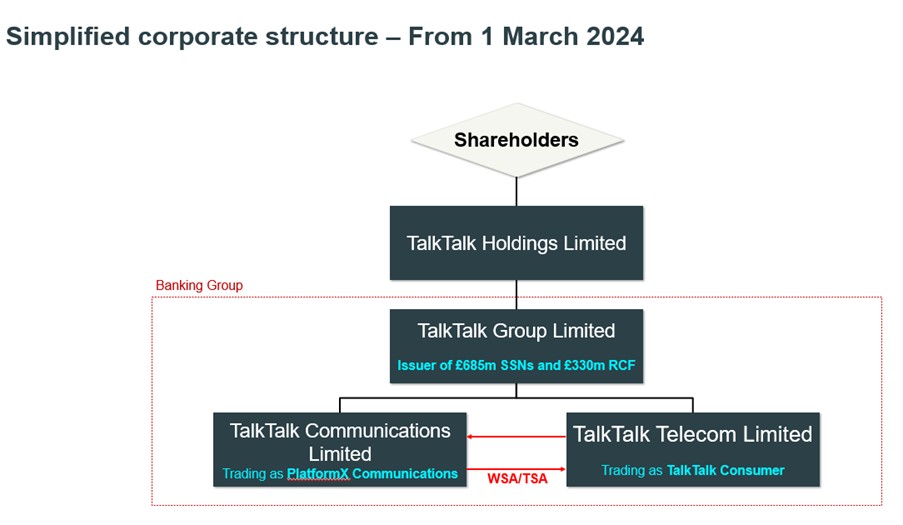

Whilst trading and reporting on a separated basis from 1 March, PXC and TalkTalk Consumer will remain within the current TalkTalk Group structure [as per below chart] whilst the existing Group debt facilities remain in place. TalkTalk Group’s current financial year ends on 29 February 2024, and the Group expects to be compliant with its debt covenants when it reports annual results.

A further announcement will be made in due course.

- Ends -

For further information please contact:

press.office@talktalkplc.com

Disclaimer: This communication contains “forward-looking statements.” Forward-looking statements, which express management’s current views concerning future business, events, trends, contingencies, financial performance, and/or financial condition, generally can be identified by the use of forward-looking terminology such as “anticipate,” “believe,” “could,” “estimate,” “expect,” “forecast,” “intend,” “may,” “plan,” “possible,” “potential,” “predict,” “project” or other similar words. Forward-looking statements are neither historical facts nor assurances of future performance. Forward-looking statements may be based on available current market and industry material as well as management’s expectations, beliefs and projections concerning future events impacting it. TalkTalk Group’s expectations, beliefs and projections are expressed in good faith, and its management believes that they have a reasonable basis to make these statements, but there can be no assurance that management’s expectations, beliefs or projections will be achieved. Because forward-looking statements relate to the future, they are difficult to predict and subject to many factors that are outside of TalkTalk Group’s control. All forward-looking statements in this update apply only as of the date made and are expressly qualified in their entirety by this cautionary statement.